Stop Donating Your Hard-Earned Money to the Banks

LoanGuard monitors your loan performance 24/7 and alerts you when you’re paying excess interest. We’ll streamline the process of switching to a better lender – because banks don’t need your donations.

Trusted by thousands of smart borrowers

Stop Donating Your Hard-Earned Money to the Banks

LoanGuard monitors your loan performance 24/7 and alerts you when you’re paying excess interest. We’ll streamline the process of switching to a better lender – because banks don’t need your donations.

Trusted by thousands of smart borrowers

Calculate your Mortgage

Calculate your Mortgage

How LoanGuard Protects Your Money.

Our advanced monitoring system works around the clock to ensure you’re getting the best deal on your loan.

Market Analysis

Compare your loan against thousands of market options to ensure you're always getting competitive rates.

Secure & Private

Your financial information is protected with bank-level security and encryption standards.

Detailed Reports

Receive comprehensive reports showing exactly how much you could save by switching lenders.

24/7 Monitoring

Our system continuously tracks your loan performance against current market rates, alerting you the moment better deals become available.

Instant Alerts

Get notified immediately when you're overpaying. No more missed opportunities to save on interest payments.

Seamless Switching

We handle the complex process of moving your loan to a better lender, making the switch as smooth as possible.

How LoanGuard Protects Your Money.

Our advanced monitoring system works around the clock to ensure you're getting the best deal on your loan.

24/7 Monitoring

Our system continuously tracks your loan performance against current market rates, alerting you the moment better deals become available.

Instant Alerts

Get notified immediately when you're overpaying. No more missed opportunities to save on interest payments.

Seamless Switching

We handle the complex process of moving your loan to a better lender, making the switch as smooth as possible.

Market Analysis

Compare your loan against thousands of market options to ensure you're always getting competitive rates.

Secure & Private

Your financial information is protected with bank-level security and encryption standards.

Detailed Reports

Receive comprehensive reports showing exactly how much you could save by switching lenders.

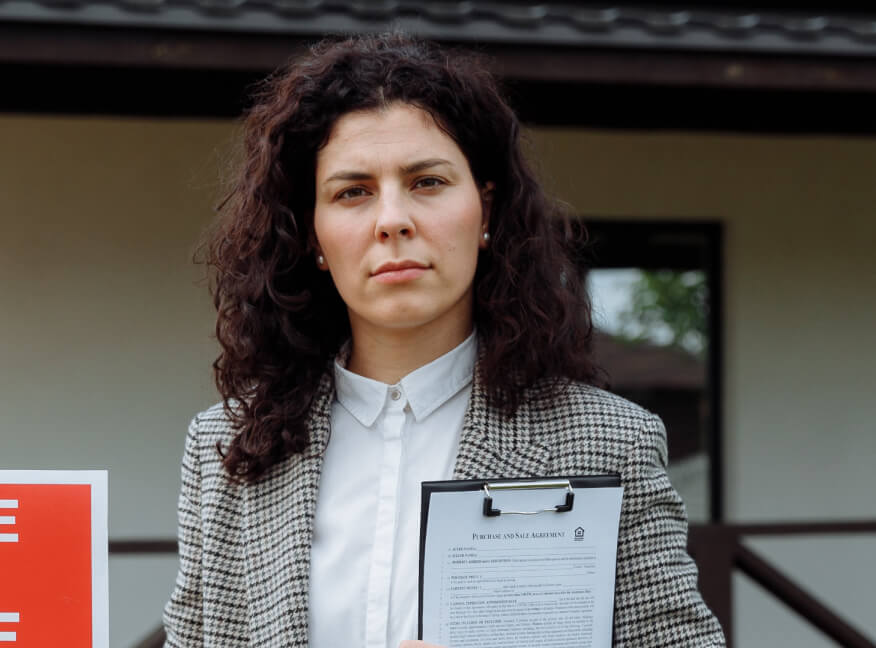

Guard Your Earnings — Your Cash ≠ Bank Charity.

LoanGuard tracks your mortgage against the market and alerts you when better rates are available. No more excess interest payments – we’ll streamline switching to a better loan.

Calculate your Mortgage

At LoanGuard, your financial security comes first. From pre-approval to closing, we protect your interests, save you money, and tailor a loan program that truly fits you. Our success is built on the trust of clients and real estate partners who rely on us every day to guide and safeguard them through the mortgage process.

2M$+

Saved in Interest98%

Success Rate

Buying a home can be overwhelming. There are so many financing options

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage financing.

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage financing.

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage financing.

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage financing.

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage financing.

How LoanGuard Works.

Sign Up & Connect

Create your account and securely connect your loan information. We'll analyze your current terms and start monitoring immediately.

We Monitor & Alert

Our system continuously scans the market for better rates. When we find a better deal, you'll get an instant alert with savings details.

We Handle the Switch

Choose to switch and we'll manage the entire process. From paperwork to negotiations, we make it seamless while you save money.

Stop Losing Money Every Month

The average Australian overpays $267 per month in excess interest. That’s $3,200 per year going straight to the banks – money that should stay in your pocket.

85%

$64K

2.1%

Free

- No upfront costs or hidden fees

- We only get paid when you save money

- Full support throughout the switching process

- Access to exclusive lender deals

2.3%

Interest Rate Reduction

3,200$

Per Year

14Days

Average Switch Time

We help people to find their best and dream house

Most people find that mortgage financing is complicated and confusing. We help you buy your dream home by simplifying the mortgage.

“Ralo helped my wife and I refinance our house and purchase an investment property. Anyone could have done that but what I really liked about her is that she was extremely ethical. She carefully listened to our concerns”

William John

05 days ago“Ralo helped my wife and I refinance our house and purchase an investment property. Anyone could have done that but what I really liked about her is that she was extremely ethical. She carefully listened to our concerns”

Laura Martinez

02 days ago“Ralo helped my wife and I refinance our house and purchase an investment property. Anyone could have done that but what I really liked about her is that she was extremely ethical. She carefully listened to our concerns”

Alex Dew

03 days ago

Visit our professional team member for your any help from us

Elizabeth White

- +1 3324 55 537

- Hilton Road, 90KY, NY, America

- elizabethwhite@ralo.com

Laura Martinez

- +1 3324 55 535

- Hilton Road, 90KY, NY, America

- lauramartinez@ralo.com

Have you any questions about our company?

On average, our clients save $64,000 over the life of their loan by avoiding hidden fees, inflated interest rates, and costly terms.

Yes — LoanGuard provides full support throughout the entire switching process. From paperwork to lender negotiations, we guide you step by step.

No. LoanGuard provides a free loan monitoring service for all users.

Absolutely not. We believe in 100% transparency — there are no upfront charges, hidden fees, or surprise costs.

We only earn when you save money. If we can’t reduce your costs, you don’t pay us.

Read the latest news on lending from Laks Mortgage company

Build a new construction and grow up the our world

If you are looking for a lender who competitive that prices and the products, stands behind.

How to your family is so happy with in behind since 2024

If you are looking for a lender who competitive that prices and the products, stands behind.

Learn advanced level design with his advanced level course

If you are looking for a lender who competitive that prices and the products, stands behind.

ChatGPT frenzy sweeps China as firms as that scramble home-grown

If you are looking for a lender who competitive that prices and the products, stands behind.

Don't Let Banks Keep Your Money

Join thousands of smart borrowers who stopped overpaying on their loans. Start protecting your hard-earned money today – because banks don't need your donations.

Don't Let Banks Keep Your Money

Join thousands of smart borrowers who stopped overpaying on their loans. Start protecting your hard-earned money today – because banks don’t need your donations.

$267

Average monthly overpayment

Every Day

You wait costs you more

2 Min

To get started

✓ Free to start ✓ No hidden fees ✓ Secure & private ✓ Cancel anytime

Trusted by over 10,000 borrowers across Australia